income tax rates 2022 south africa

73726 31 of taxable income above 353100. The tax rate for the year 2022 in South Africa for companies is 27 until March 2023.

The World Inequalityreport 2022 Presents The Most Up To Date Complete Data On Inequality Worldwide Global Wealth Ecological Inequality Income Inequality Since 1820 Gender Inequality

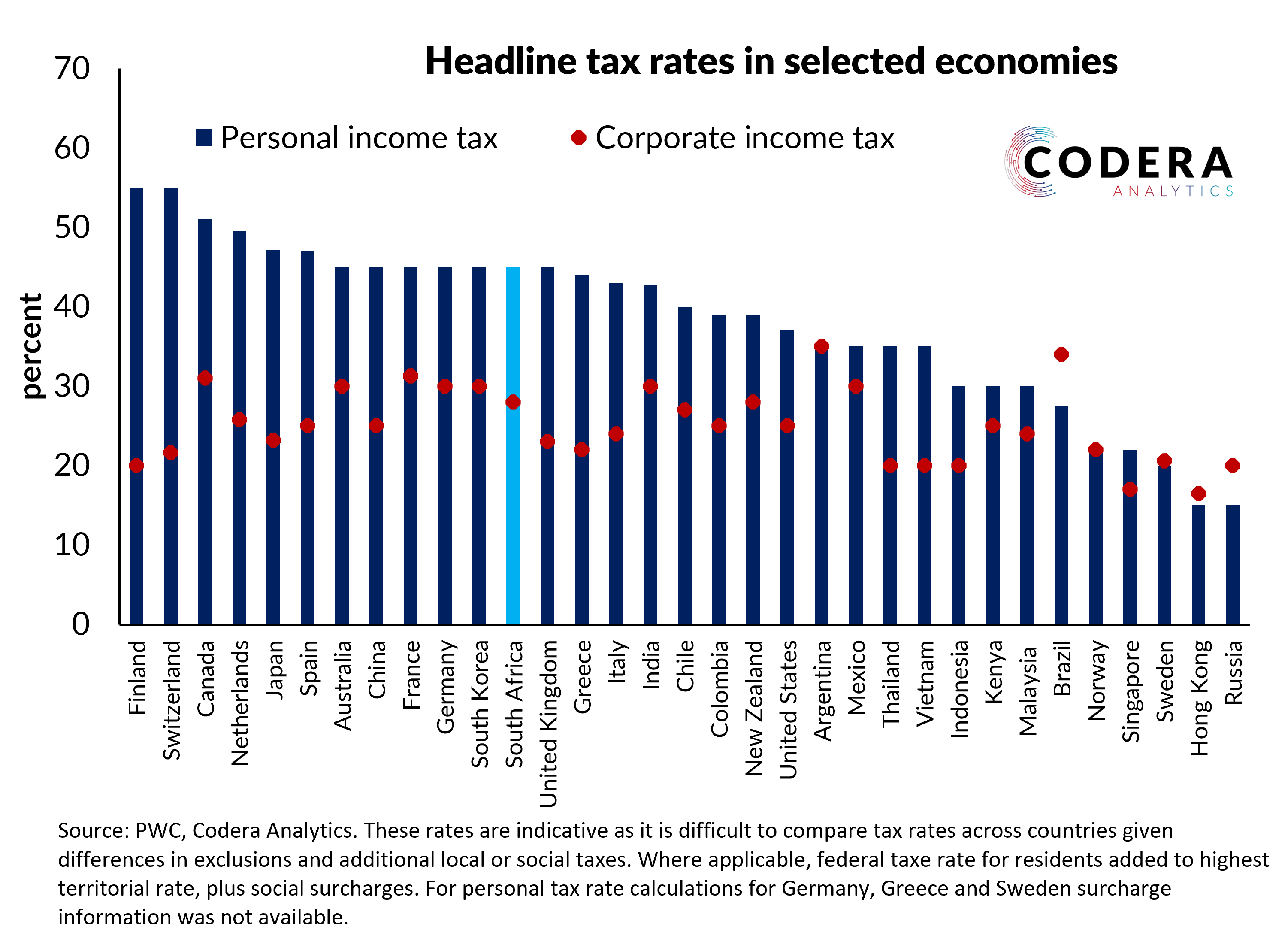

The Personal Income Tax Rate in South Africa stands at 45 percent.

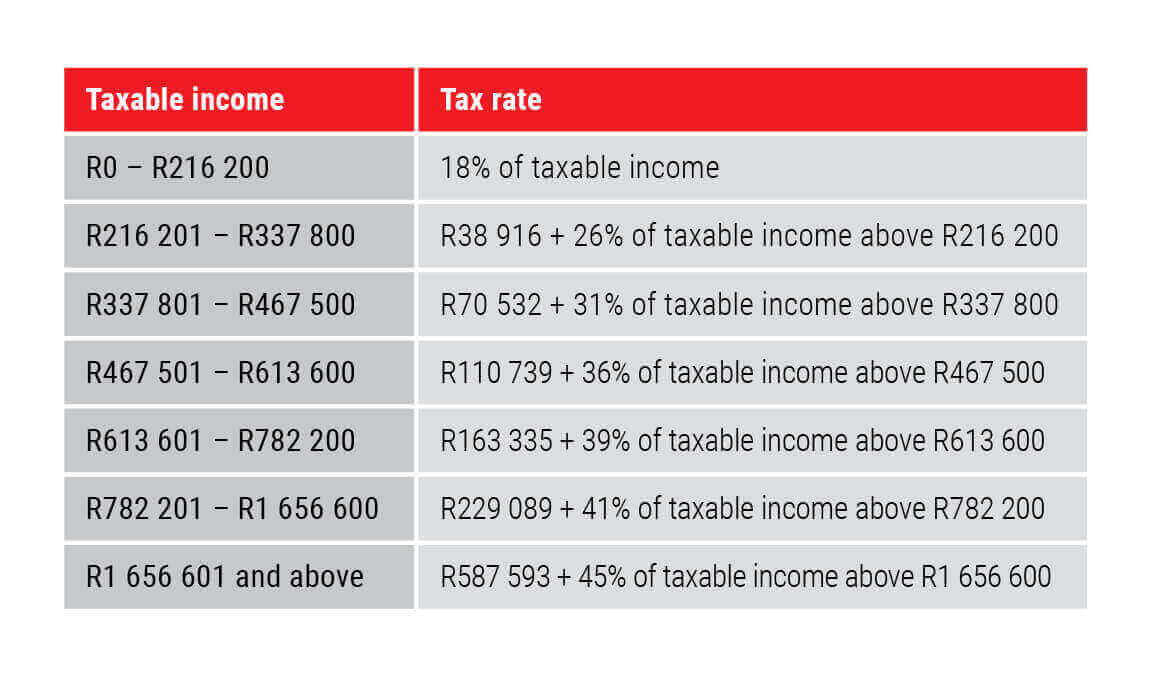

. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. The south africa annual income tax calculator for 2022 uses the tax tables from the south african revenue service. Personal income tax rates.

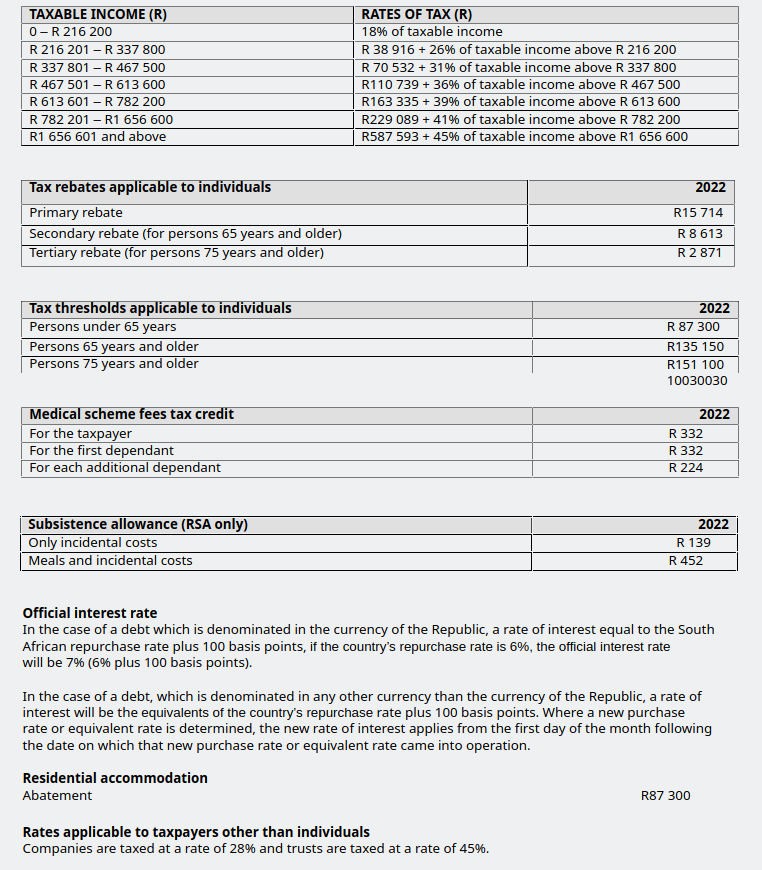

8 rows Non-residents are taxed on their South African sourced income. The tax years are. Person Rates of tax Natural persons and special trusts sliding scale 18 to 45 Trusts 45 South African companies and close corporations 28.

275 of the employees remuneration for PAYE purposes excluding retirement fund lump sums and. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. On 23 February 2022 the Minister of Finance announced that the corporate income tax rate would be reduced to 27 effective from years of assessment ending on or after 31.

Deloitte US Audit Consulting Advisory and Tax Services. Tax rates are proposed by the Minister of Finance in the annual Budget Speech and fixed or passed by Parliament each year. 2022 tax year is 1 March 2021 28 February 2022.

2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa. The same rates of tax are applicable to both residents and non-residents. 2023 tax year is 1 March 2022 28 February 2023.

Years of assessment ending on any date between 1 April 2022 and 30 March 2023. Personal Income Tax Rate in South Africa averaged 4163 percent from 2004 until 2022 reaching an all time high of 45. Taxable Income R Rate of Tax R 1 91 250 0 of taxable income 91 251 365 000 7 of taxable.

40680 26 of taxable income above 226000. For taxpayers aged 75 years and older this threshold is R157 900. You are viewing the income tax rates.

Current rates for 2022-23. After that it will be raised to 28. For individuals and sole proprietors the threshold is R91 250 if you are.

The personal income tax rate in south africa stands at 45 percent. Taxable income R Rates of tax. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate.

2021 tax year is 1 March 2020 28 February 2021. Review the latest income tax rates thresholds and personal allowances in South Africa which are used to calculate salary after tax when factoring in social security contributions pension. In this section you will find a list of income tax rates.

South Africa Residents Income Tax Tables in 2022. The important tax rates are as follows. Progressive tax rates apply for.

18 of taxable income. For the 2022 year of assessment 1 March 2021 28 February 2022 R87 300 if you are younger than 65 years. For the 2022 year of assessment 1 March 2021 28 February 2022 R87 300 if you are younger than 65 years.

7 rows 23 February 2022 See the changes from the previous year. South Africa Residents Income Tax Tables in 2022.

Jalico Accounting Services Budget Speech Summary Corporate Income Tax Rate Will Reduce To 27 From 2023 Tax Year Facebook

List Of Countries By Tax Rates Wikipedia

South Africa S Highest Tax Rate Vs The Uk Dubai Hong Kong And New York

Individual Income Taxes Urban Institute

Tax Tables For Individuals And Trusts 2022 Tax

Income Tax In Germany For Expat Employees Expatica

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Top 8 Countries With No Income Tax That You Should Know

.jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Allan Gray 2021 Budget Speech Update

.png)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Nfb Private Wealth Management On Twitter The Corporate Income Tax Rate Will Be Lowered To 27 Per Cent For Companies With Years Of Assessment Commencing On Or After 1 April 2022

Germany Taxes Germany Income Tax Germany Tax Rates Germany Economy Germany Business For Enterpenures 2022

Projected 2023 Income Tax Rates Cpa Practice Advisor

:max_bytes(150000):strip_icc()/dotdash-brief-history-income-inequality-united-states-v2-e1657ae60b174cfdaca042d52c54c7c1.jpg)

A Brief History Of Income Inequality In The U S

Daan Steenkamp On Twitter South Africa S Headline Personal And Corporate Tax Rates Are Relatively High Compared To The Median Rates Across Major Economies Read More Https T Co H3hzmzsmie Https T Co Jinxowy09u Twitter

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)